Corgi Labs

About Corgi Labs

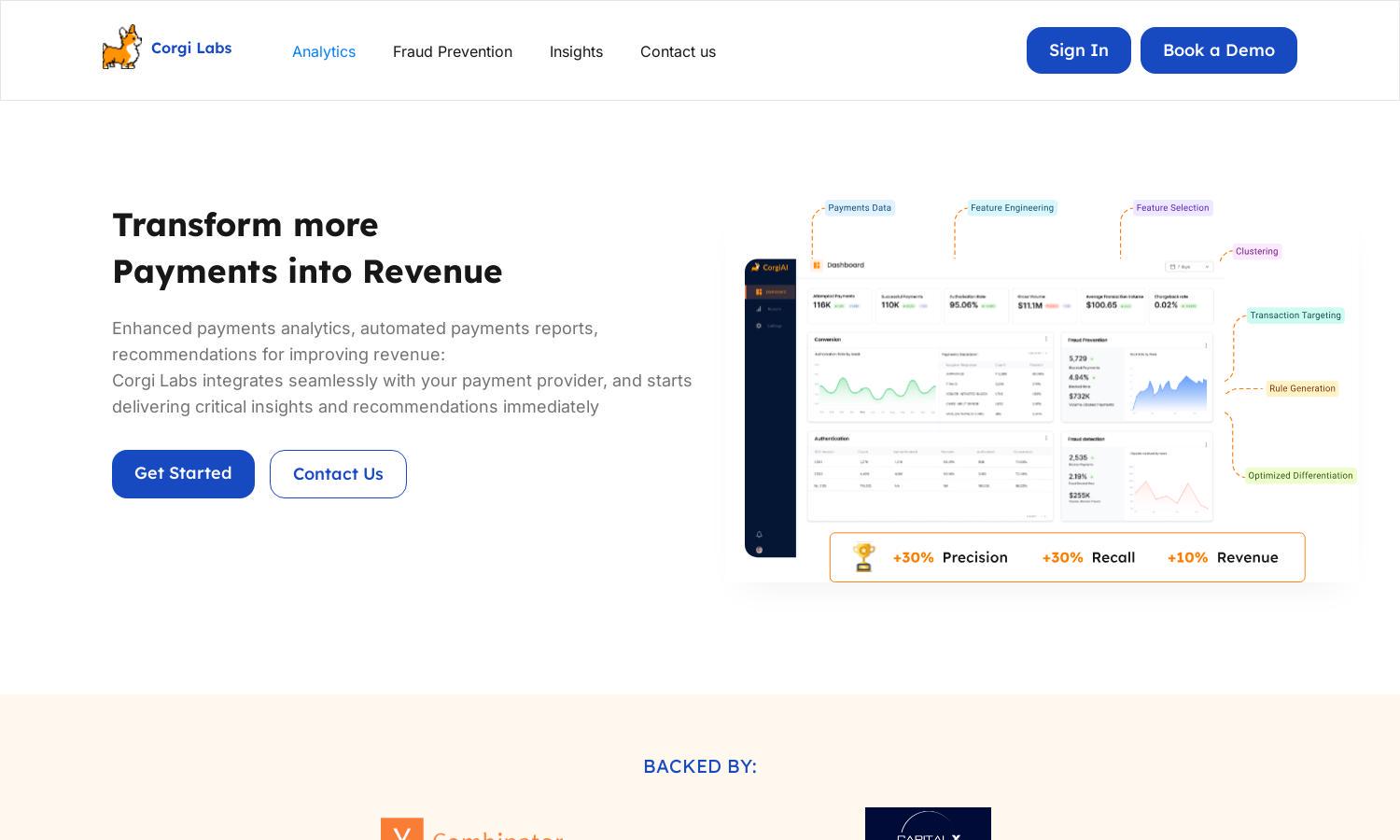

Corgi Labs specializes in AI-driven payment optimization and fraud prevention, designed for businesses of all sizes. By leveraging powerful analytics, the platform identifies critical payment issues that lead to revenue loss. Corgi Labs helps users prevent fraud and improve customer retention effortlessly.

Corgi Labs offers tiered pricing plans to cater to various business sizes: Startup at $99/month, Pro at $399/month, and Enterprise at $1299/month. Each plan includes tailored features, automated fraud prevention, and payment optimization, allowing businesses to choose the best fit for their needs.

Corgi Labs boasts a user-friendly interface with intuitive navigation, ensuring seamless interaction with features such as fraud dashboards and payment analytics. The layout is designed for efficiency, making it easy for users to access critical data and insights that enhance their overall experience.

How Corgi Labs works

Users interact with Corgi Labs by integrating it with their current payment processors like Stripe and Adyen for swift onboarding. The platform provides intuitive dashboards for payments and fraud analytics, empowering users to identify issues, implement solutions, and optimize their revenue streams effectively.

Key Features for Corgi Labs

Automated Payment Optimization

Corgi Labs' Automated Payment Optimization feature streamlines transaction processes, helping businesses reduce false declines and increase revenue. This unique offering not only enhances user experience but also integrates seamlessly with major payment providers, ensuring a smooth flow of operations for users.

Fraud Prevention Analytics

Corgi Labs features advanced Fraud Prevention Analytics that enable users to monitor and mitigate risks effectively. By analyzing transaction patterns, this feature helps businesses detect fraudulent activities early, thus protecting their revenues and fostering trust with customers.

Weekly Summary Reports

Corgi Labs provides Weekly Summary Reports that deliver comprehensive insights into payment performance and fraud activities. This feature enables businesses to track their progress, identify trends, and make data-driven decisions, ensuring continuous improvement in payment processing and fraud management.

You may also like: