Jinnee

About Jinnee

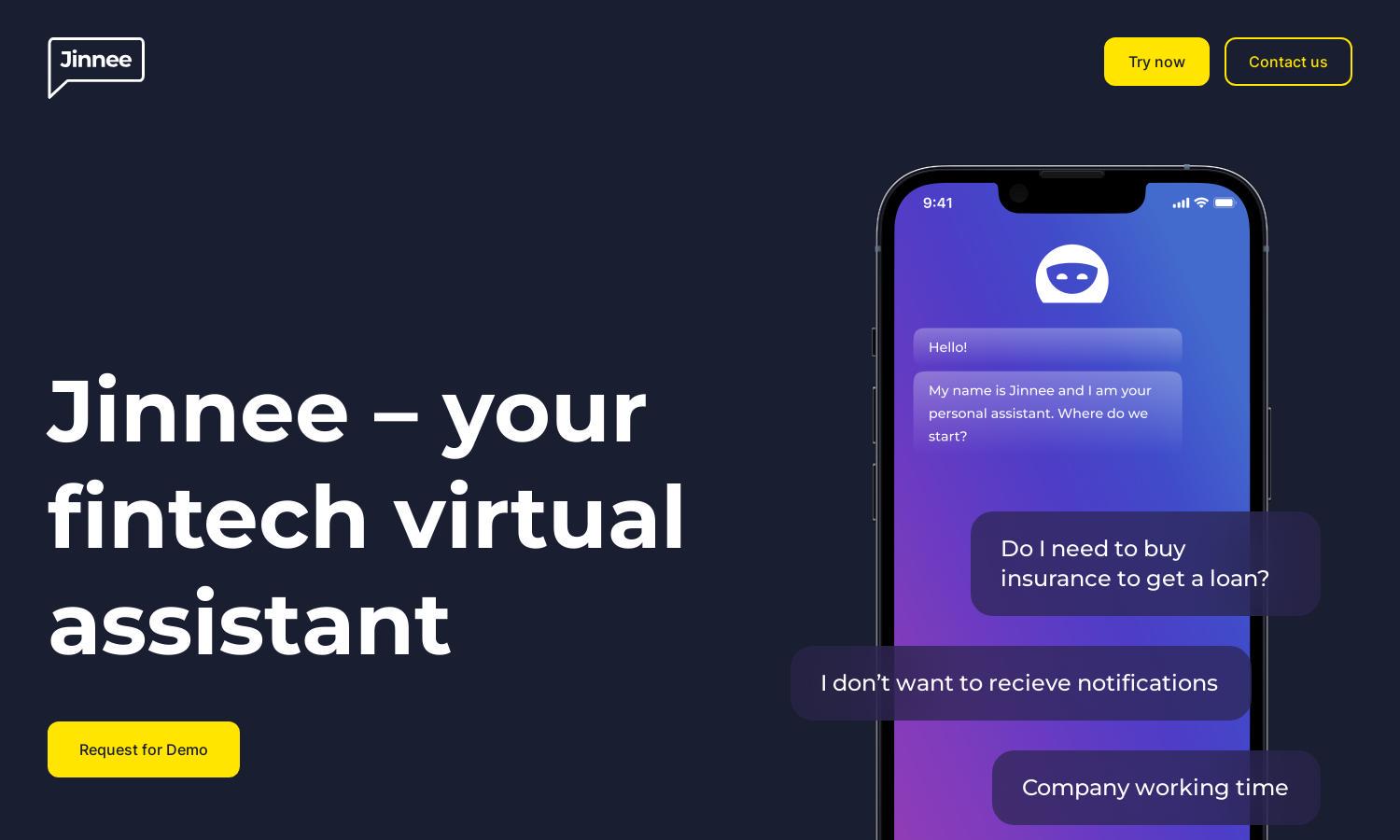

Jinnee is an AI-powered virtual assistant designed for fintech companies, offering quick and effective customer support. Its innovative feature includes 24/7 availability, allowing users to get instant answers to their banking queries. Jinnee analyzes inquiries, giving insights that help businesses understand their clients better.

Jinnee offers flexible pricing plans tailored for businesses of all sizes. Each tier provides unique benefits, from essential support features to advanced analytics. Upgrading enhances customer service capabilities and improves insights into user needs, ensuring that Jinnee delivers optimal value to fintech companies.

Jinnee boasts an intuitive user interface that ensures seamless navigation for users. The layout is designed for maximum efficiency, enabling quick access to support features, personalized banking services, and insightful analytics. This design enhances the overall user experience, making it easy and engaging to interact with Jinnee.

How Jinnee works

Users interact with Jinnee by onboarding through a simple setup process, allowing them to customize their chatbot features. Once integrated, navigating the platform is straightforward, with the ability to access real-time analytics, automated responses to common inquiries, and personalized banking advice, ensuring a seamless user experience.

Key Features for Jinnee

24/7 Customer Support

Jinnee provides unparalleled 24/7 customer support, ensuring users receive timely assistance anytime, anywhere. This feature reassures fintech companies that they can address customer inquiries instantly, enhancing user satisfaction and fostering loyalty by providing immediate responses to common banking queries.

Personalized Banking Services

With Jinnee’s personalized banking services, clients receive tailored financial advice. Jinnee, as a virtual financial advisor, assists users with budgeting, savings plans, and other needs, ensuring they receive relevant product recommendations based on their individual financial backgrounds, enhancing user engagement and satisfaction.

Automated Learning

Jinnee features automated learning capabilities, allowing it to identify and learn from client interactions. This continuous improvement enhances its ability to respond accurately to user queries, increasing customer satisfaction. By evolving based on user needs, Jinnee optimizes the support experience for fintech businesses.

You may also like: