Kintsugi

About Kintsugi

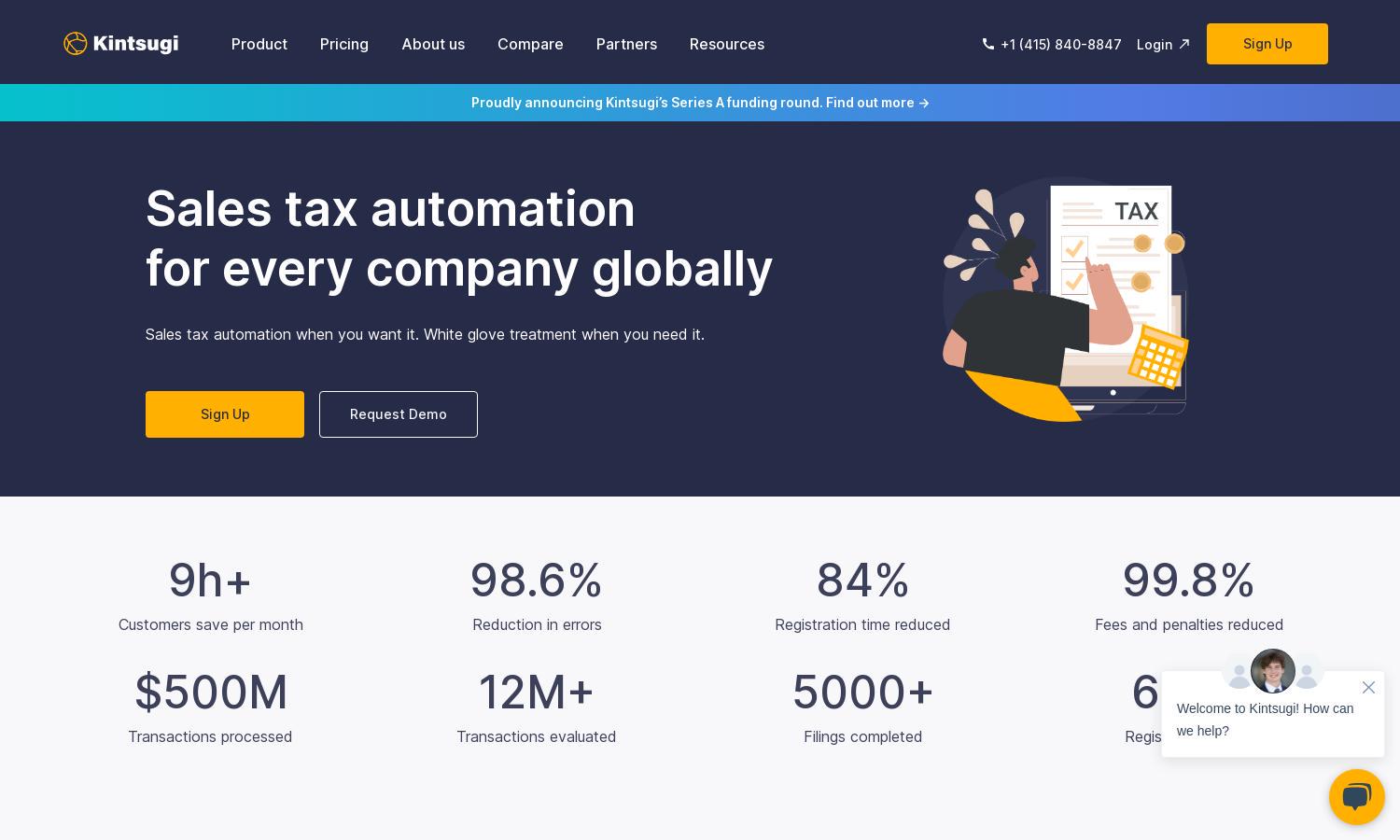

Kintsugi revolutionizes sales tax compliance for businesses by providing an easy-to-use automation platform. Tailored for companies of all sizes, it integrates seamlessly with billing and e-commerce systems, ensuring accurate tax calculations. This innovative tool takes the stress out of compliance, helping businesses save time and reduce risks.

Kintsugi offers flexible pricing with no long-term contracts. Users can start for free, enjoying full automation of sales tax compliance without upfront costs. Monthly subscriptions charge based on filings made, ensuring you only pay for what you use. This pay-as-you-go approach is ideal for dynamic businesses.

Kintsugi features a sleek, user-friendly interface designed to simplify sales tax management. The intuitive layout guides users through setup and monitoring processes, ensuring optimal usability. Unique features, such as automated alerts and seamless integrations, enhance the experience, making Kintsugi an indispensable tool for efficient compliance.

How Kintsugi works

To start using Kintsugi, users sign up for a free account and undergo a quick onboarding process that includes a comprehensive audit to assess their nexus. Once registered, users can integrate their billing and e-commerce platforms, allowing Kintsugi to automatically calculate and manage their sales tax obligations effortlessly.

Key Features for Kintsugi

Automated Tax Calculations

Kintsugi's automated tax calculation feature ensures businesses collect and remit sales tax accurately. By utilizing precise rules tailored to each product, Kintsugi removes the guesswork from compliance, enabling users to focus on their core business operations while confidently managing their tax responsibilities.

Seamless E-commerce Integration

The seamless e-commerce integration of Kintsugi connects with major platforms like Shopify, enabling businesses to automate their sales tax processes directly within their existing workflows. This integration simplifies tax compliance across different sales channels, promoting efficiency and reducing the potential for costly errors.

Built-in Filing and Remittance

Kintsugi offers built-in filing and remittance capabilities, making tax reporting straightforward. Users can file accurately and on time, simplifying what would typically be a tedious process. This feature enhances user compliance and ensures that businesses stay current with their tax obligations with minimal effort.