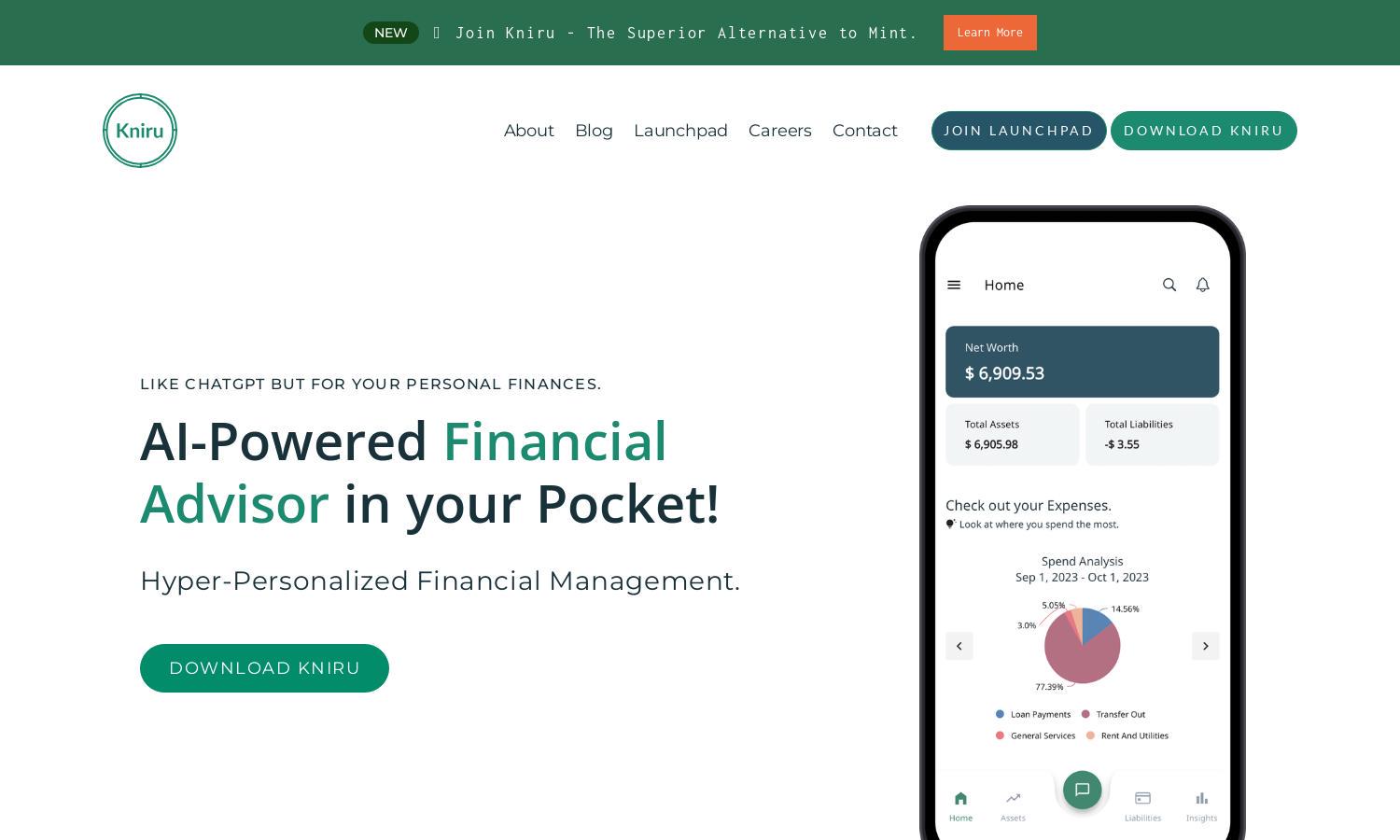

Kniru

About Kniru

Kniru is your go-to AI-powered financial advisor, designed for individuals seeking personalized financial insights. It assists users with investment advice, expense management, and retirement planning, solving complex financial queries with ease. Experience innovative financial management on-the-go with Kniru by your side.

Kniru offers flexible pricing plans tailored to diverse user needs, ensuring everyone can access its AI financial advisory services. Discover tiered subscription options that provide valuable benefits like advanced insights and personalized alerts, enhancing your financial journey with Kniru and optimizing your wealth management experience.

Kniru's user interface is designed for seamless navigation, featuring intuitive layouts and easy-to-access tools. The platform offers user-friendly navigation for all financial needs, ensuring that clients can quickly find investment advice, retirement tips, and actionable insights, all within the engaging environment Kniru creates.

How Kniru works

Users begin their journey with Kniru by easily onboarding and linking their financial accounts. The platform offers a holistic view of assets and liabilities while providing personalized financial insights and alerts. As users engage with Kniru, they can ask financial questions and receive tailored guidance for improving their wealth management.

Key Features for Kniru

AI-Powered Financial Insights

Kniru's AI-powered financial insights empower users with personalized data and advice. This dynamic feature analyzes individual financial situations, providing tailored solutions that lead to smarter decision-making and enhanced financial well-being, making Kniru an indispensable tool for anyone serious about financial management.

Automated Notifications

Kniru's automated notifications keep users informed and proactive about their finances. This feature sends alerts for bill reminders, budget overspends, and investment opportunities, ensuring users never miss a critical update. With Kniru, users can effortlessly manage their financial journey effectively.

Investment and Expense Management

Kniru offers comprehensive investment and expense management tools that allow users to track financial performance in real-time. This feature helps users understand spending patterns, optimize their budgets, and make informed investment strategies for future financial growth, enhancing their overall financial experience.

You may also like: