Paymefy

About Paymefy

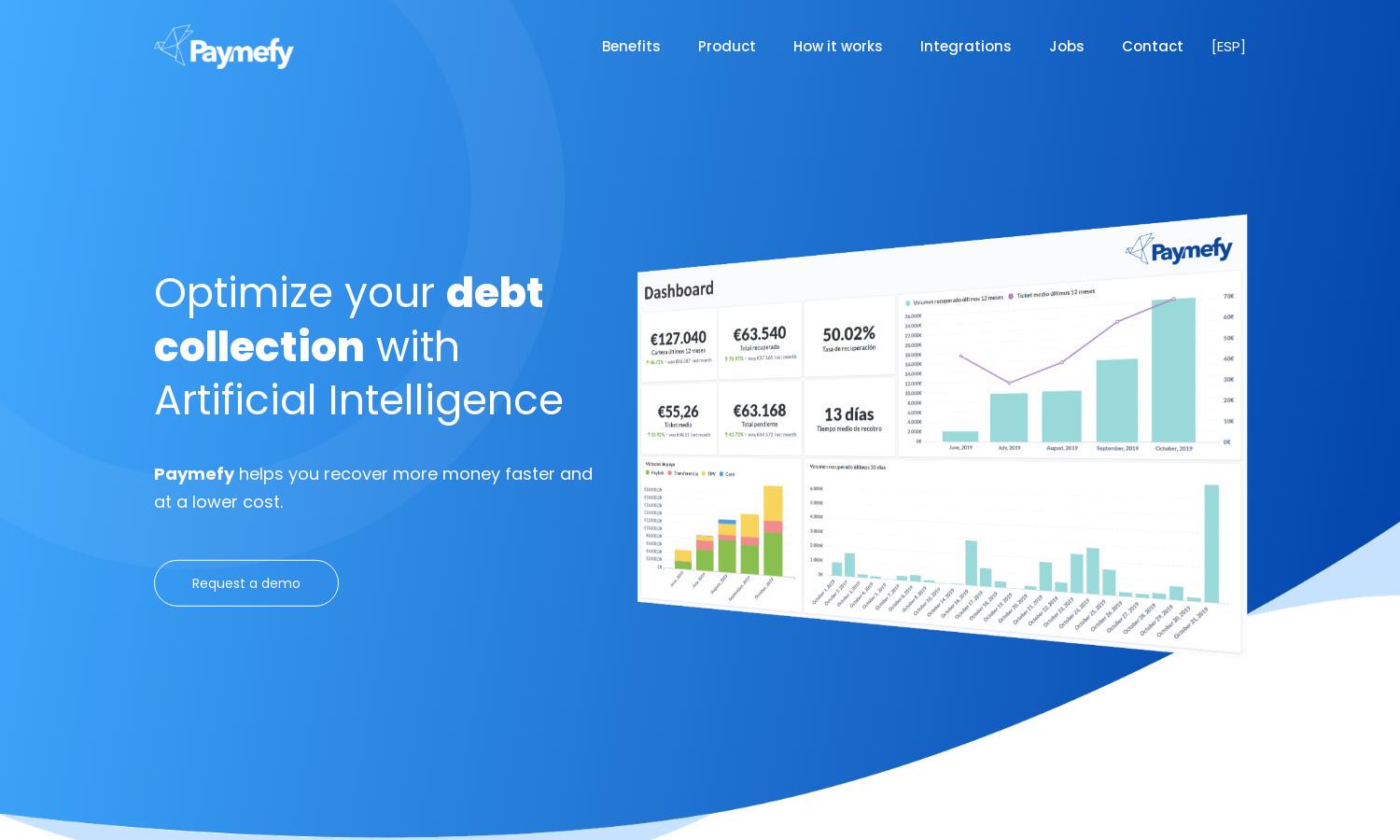

Paymefy is designed for businesses seeking efficient debt collection solutions. Utilizing artificial intelligence, it automates notifications and streamlines payments, allowing users to recover debts faster and reduce operational costs. With customizable links and integration with existing systems, Paymefy addresses modern debt recovery challenges.

Paymefy offers flexible pricing plans to meet diverse business needs. Each tier is designed to provide comprehensive features that enhance debt collection efforts, allowing users to choose the plan that best fits their operational requirements. Upgrading unlocks advanced functionalities for more efficient debt recovery.

Paymefy's user interface is crafted for maximum accessibility and ease of use. The intuitive layout ensures that users can navigate effortlessly, accessing features that streamline the debt collection process. Enhanced user-friendly tools allow businesses to recover debts with minimal effort, enhancing overall productivity.

How Paymefy works

Users begin by integrating their existing CRMs with Paymefy, allowing for the automatic extraction of unpaid invoices. Once onboarded, users can set up automated notification sequences, customizing them to fit their brand identity. Customers receive payment links via multiple channels, facilitating easy, secure transactions while Paymefy provides insights into customer behaviors.

Key Features for Paymefy

Automated Notification Sequences

Paymefy's automated notification sequences are a standout feature that enhances debt collection efficiency. By utilizing AI, Paymefy ensures timely reminders through various online channels, improving the chances of payment. This unique capability saves businesses time and effort while optimizing recovery processes.

Customizable Payment Links

Paymefy offers customizable payment links that allow customers to settle invoices quickly and securely. Tailored to reflect your brand, these links streamline the payment process, enhancing user experience and encouraging faster debt recovery, setting Paymefy apart in the debt collection landscape.

Multi-Invoice Payment Options

A distinctive feature of Paymefy is its ability to collect multiple receivables simultaneously. Customers have the flexibility to pay multiple unpaid invoices at once or choose specific ones, offering a tailored and convenient payment experience, which significantly boosts recovery rates for businesses.