Skwad

About Skwad

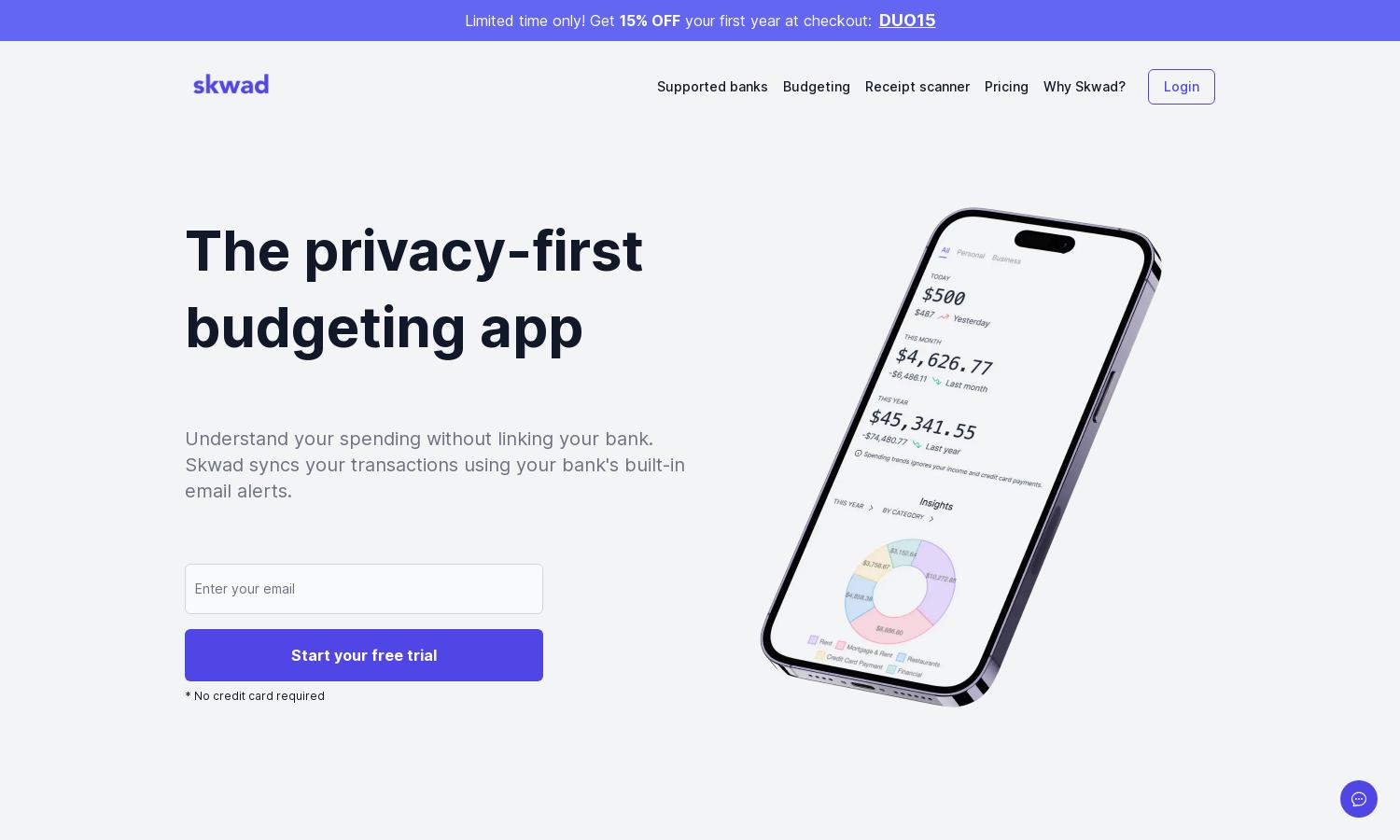

Skwad is a privacy-first budgeting app that empowers users to manage their finances without compromising security. By using bank email alerts, it syncs transactions instantly, allowing for categorized tracking of income and expenses, ensuring financial clarity while safeguarding personal information.

Skwad offers flexible subscription plans with a free trial option. Users benefit from features like expense tracking through email alerts. Each tier provides enhanced functionalities tailored to user needs. Discounts such as 15% off the first year with code DUO15 make upgrading appealing.

Skwad's user interface is designed for simplicity and efficiency, creating a seamless navigation experience. The clean layout combined with user-friendly features allows anyone to track their finances easily. Skwad aims to enhance user engagement with intuitive design elements and straightforward accessibility.

How Skwad works

Users start by signing up for Skwad, receiving a unique scan email address. They can then set automated alerts from their bank to this address. Skwad processes these alerts in real-time, categorizing transactions automatically. The platform's straightforward design makes finance management easy and efficient.

Key Features for Skwad

Automated Transaction Tracking

Skwad's automated transaction tracking feature sets it apart, allowing users to receive and categorize bank alerts without sharing sensitive login information. This unique approach ensures instant updates and better financial clarity, maximizing user control over their budgeting journey.

Customizable Expense Categories

With Skwad's customizable expense categories, users can personalize their budget according to their financial needs. This key feature enhances the user experience by providing flexibility in managing expenses, making it easier to track spending habits effectively.

Loan Payment Reminders

Skwad's loan payment reminder feature ensures users never miss a payment by syncing bills to their calendar. This unique functionality helps users manage their financial responsibilities effortlessly, providing peace of mind and reducing the risk of late fees.

You may also like: