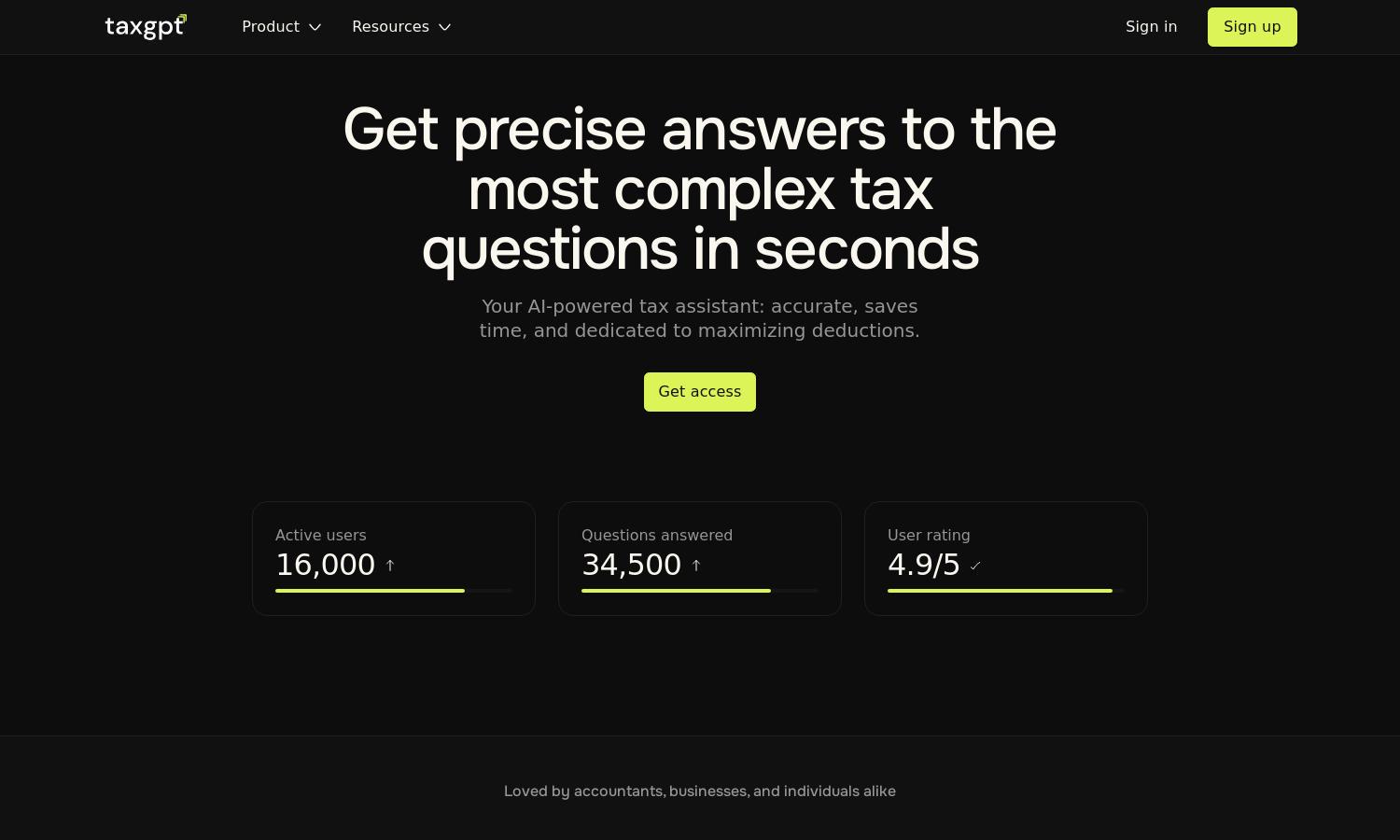

TaxGPT

About TaxGPT

TaxGPT serves accountants and tax professionals with AI-driven solutions for tax research and document management. By providing accurate and real-time assistance, TaxGPT helps users save time and enhance their productivity. Its innovative co-pilot feature makes navigating complex tax queries seamless for professionals while ensuring data security.

TaxGPT offers a free 14-day trial, allowing users to experience premium features without commitment. Following the trial, subscription tiers provide additional functionalities to enhance productivity for tax professionals. Upgrading allows users access to exclusive features tailored for maximizing efficiency in tax operations, ensuring top-notch service.

TaxGPT features a user-friendly interface that prioritizes seamless navigation and quick access to essential tools. Its intuitive design allows accountants and tax professionals to interact effortlessly with the platform, enabling efficient tax research and client management. This enhances user experience and promotes effective communication through the software.

How TaxGPT works

Users start by signing up for TaxGPT and gaining access to its intuitive interface. They can then engage with the AI-powered features, such as tax research and memo writing, by inputting queries or uploading necessary documents. TaxGPT processes information swiftly, delivering accurate and relevant answers, significantly improving productivity for accountants and tax professionals.

Key Features for TaxGPT

AI Tax Co-Pilot

The AI Tax Co-Pilot feature of TaxGPT revolutionizes tax processes for professionals, offering unmatched accuracy and efficiency. By leveraging advanced algorithms, TaxGPT ensures users receive reliable, real-time answers to complex queries, ultimately saving time and enhancing the quality of service provided to clients.

Document Management

TaxGPT's document management functionality simplifies the way tax professionals handle client files. Users can easily upload documents, receive summaries, and track next steps, ensuring organized workflows. This feature significantly reduces the time spent on administrative tasks, allowing professionals to focus on higher-value activities.

Secure Data Encryption

Security is a priority for TaxGPT, as it employs advanced encryption techniques to protect sensitive information. Users can trust that their data remains confidential and secure throughout their interactions, which is essential for maintaining client trust and complying with regulatory standards in the tax profession.

You may also like: