Chart

About Chart

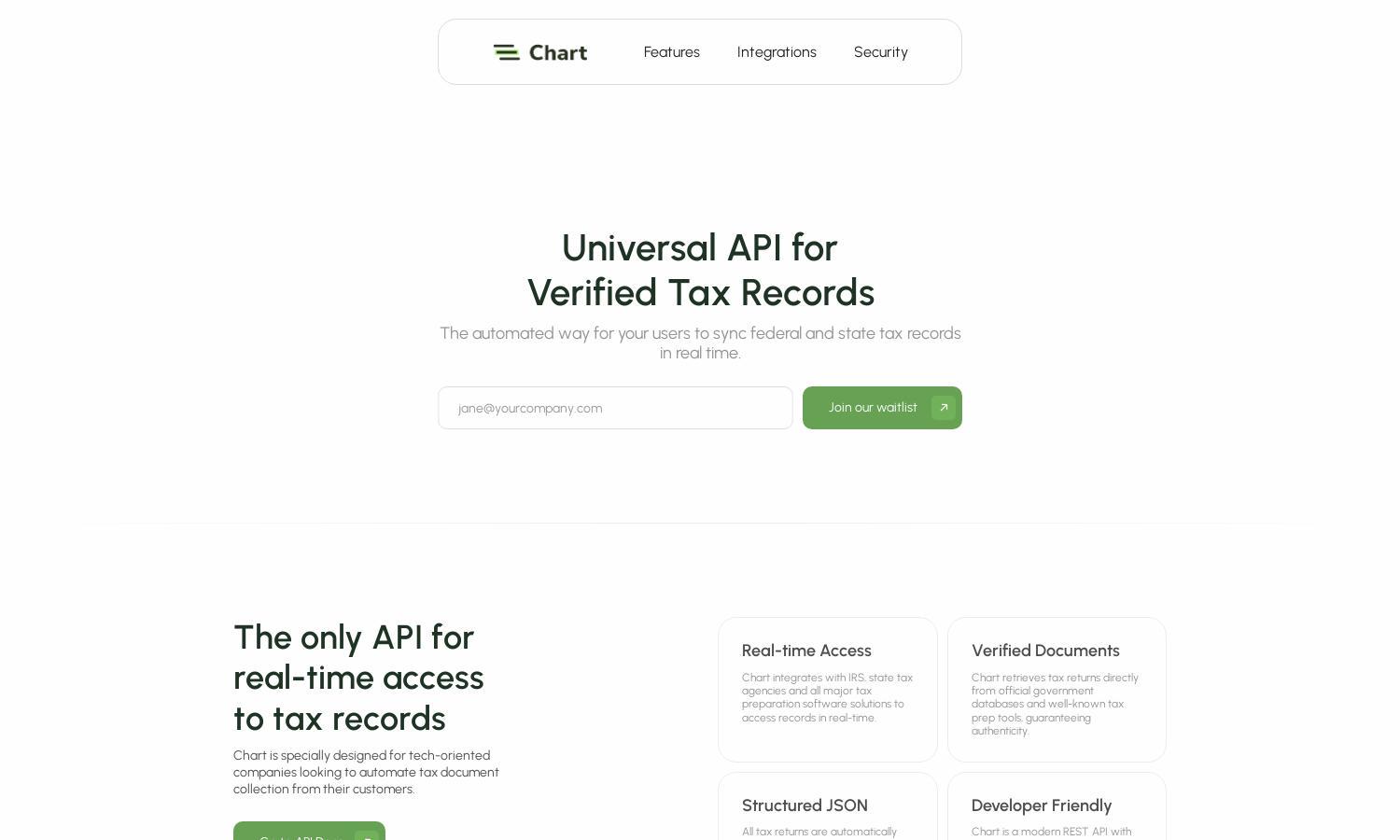

Chart is an innovative platform enabling real-time access to verified tax records through a universal API. Targeting tech-oriented companies, it simplifies tax document collection by securely integrating with IRS and state agencies. Chart's developer-friendly interface ensures ease of use while guaranteeing data authenticity and security.

Chart offers flexible pricing plans competitively designed for businesses, ensuring access to verified tax records. Each tier provides escalating benefits, including advanced integrations and enhanced security features. By upgrading, users gain access to premium support and compliance reports, making Chart an ideal choice for tech-focused companies.

Chart features an intuitive user interface, designed for seamless navigation and efficient tax document access. The layout enhances the user experience with clear pathways to essential features, such as real-time integrations and data management, making Chart user-friendly and accessible for developers and business professionals.

How Chart works

Users interact with Chart by first registering on the platform and completing a straightforward onboarding process. They can then connect their IRS or state tax accounts, upload PDFs, or integrate with tax preparation software. The API facilitates real-time access to verified tax records, ensuring security and ease of use throughout the process.

Key Features for Chart

Real-time Tax Record Access

Chart's real-time tax record access is a key feature, allowing users to seamlessly retrieve verified tax documents directly from government databases and trusted tax preparation tools. This unique capability enhances efficiency and accuracy, making it invaluable for businesses needing reliable tax data without delays.

Verified Document Retrieval

With Chart's verified document retrieval, users benefit from guaranteed authenticity, as tax returns are pulled directly from official databases. This feature not only ensures accuracy but also establishes trustworthiness, crucial for businesses aiming to automate tax document collection while maintaining compliance and security.

Structured JSON Data Format

Chart processes all tax returns into structured JSON objects using advanced OCR technology. This unique feature allows for easy integration of tax data into applications, enabling developers to work efficiently with tax documents and facilitate better user experiences in their own platforms.

You may also like: