CPA Pilot

About CPA Pilot

CPA Pilot is an advanced AI-driven platform designed to streamline tax processes for tax professionals. By providing instant access to authoritative resources, it enhances efficiency in research and client communication. Its innovative AI ensures precise tax insights, solving the challenges faced by accountants and improving overall client satisfaction.

CPA Pilot offers various pricing plans suited for different user levels, including Light Users for $20/month, Average Users for $49/month, and Power Users for $99/month. Each plan provides a 7-day free trial with 20 messages, making it easy to find the right fit for tax professionals seeking efficient solutions.

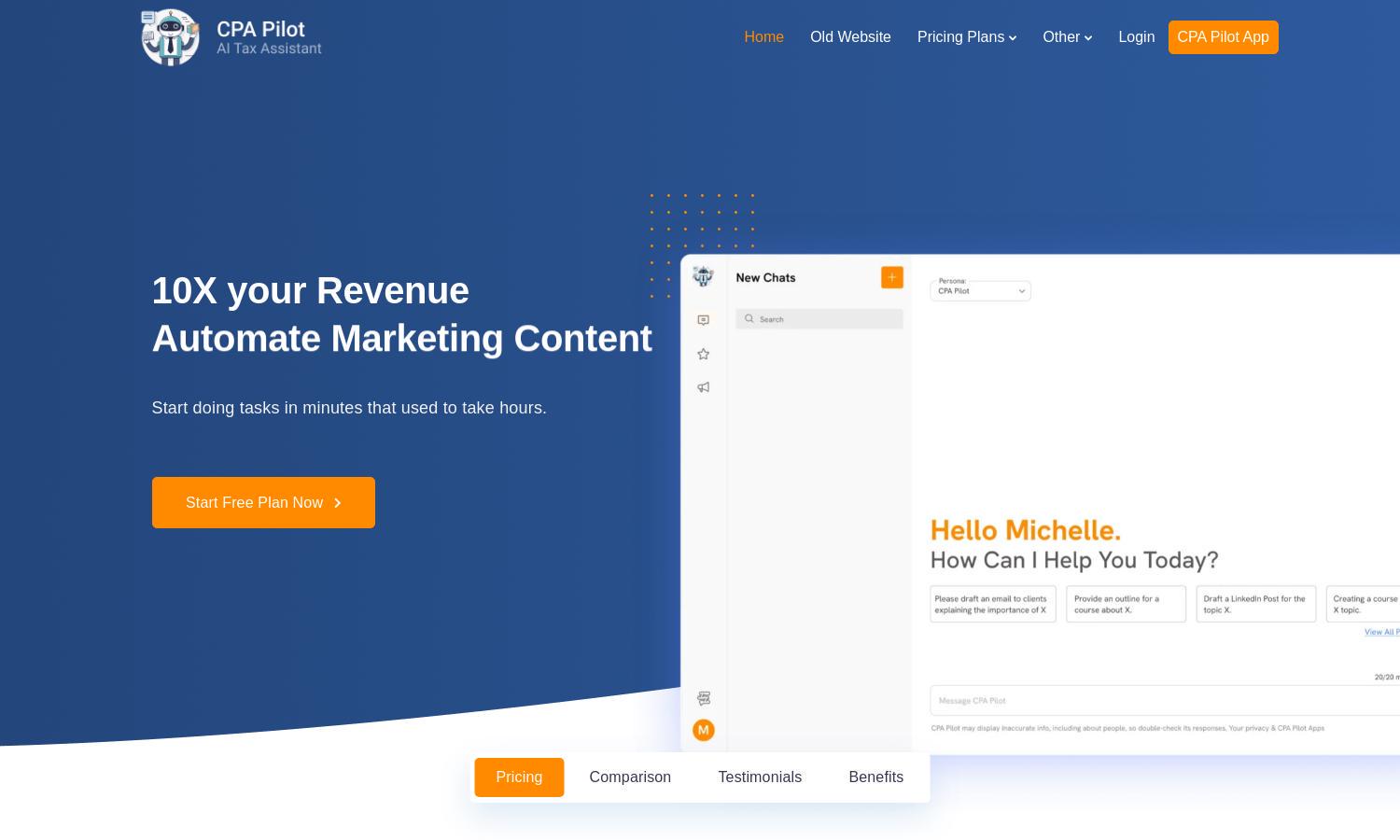

CPA Pilot features a user-friendly interface designed to facilitate seamless navigation and quick access to tools. Its layout is optimized for efficient tax research and communication, allowing users to swiftly find the information they need. This thoughtful design enhances the overall user experience for tax professionals.

How CPA Pilot works

Users begin their journey with CPA Pilot by signing up for a free 7-day trial. Upon onboarding, they gain immediate access to a wealth of authoritative tax resources. By inputting their queries, users can receive tailored, precise answers in moments. The platform's user-friendly design ensures effortless navigation, enabling accountants to leverage its features for efficient tax research and client communication.

Key Features for CPA Pilot

AI-Driven Tax Insights

CPA Pilot's AI-Driven Tax Insights feature offers precise, authoritative answers to complex tax queries. Leveraging GPT-4 technology, CPA Pilot ensures tax professionals receive accurate guidance, empowering them to make informed decisions quickly and efficiently, enhancing their overall productivity.

Instant Technical Support

The Instant Technical Support feature of CPA Pilot allows users to access immediate assistance for their tax software needs. By providing swift answers to technical questions, CPA Pilot eliminates time-consuming searches, enabling tax professionals to focus on their work without delays.

Client Communication Automation

Client Communication Automation within CPA Pilot enables tax professionals to craft detailed emails and responses effortlessly. This feature enhances client satisfaction through timely and thorough communication, allowing accountants to streamline their interactions and improve overall client relationships.