finbots.ai

About finbots.ai

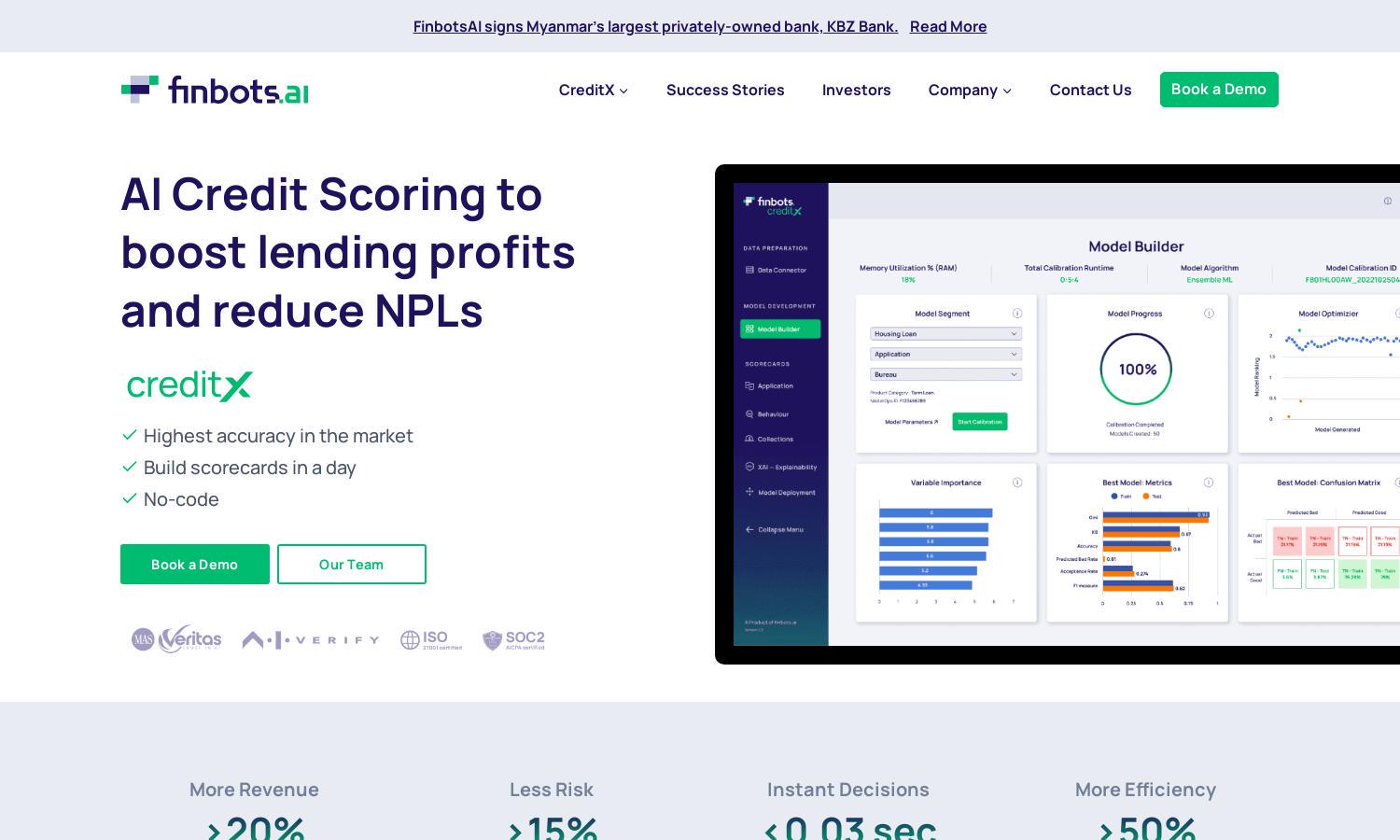

finbots.ai is a cutting-edge AI credit risk platform designed for financial institutions seeking enhanced decision-making tools. With its innovative solution, CreditX, users can quickly build and deploy accurate credit scorecards to improve lending profitability and reduce risks, ultimately transforming the credit assessment process.

finbots.ai pricing plans offer flexible tiers to suit various lending needs. The initial 30% discount for the first six months adds great value, allowing institutions to experience advanced AI capabilities at an affordable cost. Upgrading provides access to enhanced features and improved operational efficiency for users.

The user interface of finbots.ai is designed for seamless navigation, featuring a clean layout that enhances user experience. Its intuitive dashboard allows quick access to features like credit scorecard creation and deployment, ensuring users can efficiently manage their lending processes with ease and clarity.

How finbots.ai works

Users start by onboarding with finbots.ai, where they can easily connect internal, external, and alternative data sources to the platform. The proprietary AI technology automatically builds, validates, and deploys custom credit scorecards. Users can track performance, make real-time decisions, and continuously optimize their lending strategies with ease.

Key Features for finbots.ai

Custom AI Scorecards

Custom AI scorecards are a unique feature of finbots.ai, allowing lenders to build high-accuracy credit models with ease. This feature empowers users to generate tailored assessments that enhance decision-making and significantly improve lending profitability.

Rapid Deployment

Rapid deployment is another standout feature of finbots.ai, enabling users to launch tailored credit scoring solutions in days rather than months. This capability ensures financial institutions can react quickly to market needs, enhancing their competitive edge in lending decisions.

AI-Driven Insights

AI-driven insights offered by finbots.ai provide financial institutions with actionable data analysis to enhance their credit assessments. This feature allows users to identify patterns and make informed lending decisions, streamlining risk management and improving overall operational efficiency.

You may also like: