Pennyflo

About Pennyflo

Pennyflo provides businesses with an innovative AI Cash Management Suite designed to streamline cash flow management. With real-time cash tracking and dynamic forecasting, users can automate financial tasks for better efficiency. This enhances informed decision-making and mitigates cash shortage risks, making it a must-have tool for finance teams.

Pennyflo offers multiple pricing plans tailored for businesses of all sizes, from startups to enterprises. Each tier unlocks features that enhance cash flow management, with special discounts available for annual subscriptions. Upgrading plans provides access to advanced analytics and automation tools, maximizing return on investment.

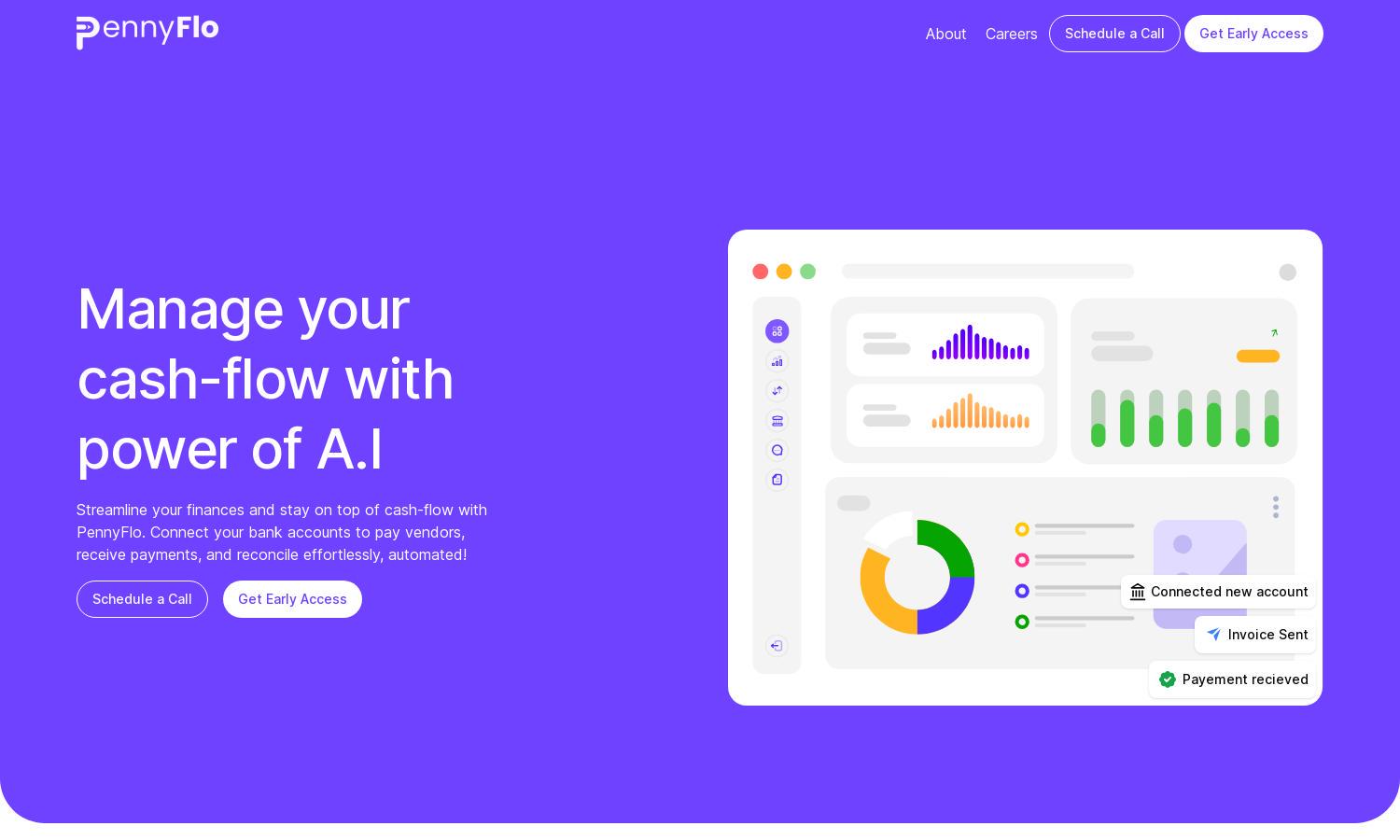

Pennyflo’s user interface is designed for seamless navigation and an intuitive experience. The clean layout facilitates quick access to real-time cash reports and data visualizations. Unique features enhance user productivity, making cash management straightforward and efficient, ensuring every financial task is just a few clicks away.

How Pennyflo works

To start using Pennyflo, users sign up and complete the simple onboarding process, which connects their financial accounts. The dashboard offers a unified view of cash flow, enabling users to visualize trends and forecasts. From there, features such as automated workflows and banking integrations help streamline processes, ensuring efficient cash management.

Key Features for Pennyflo

AI-Powered Cash Flow Management

Pennyflo’s AI-powered cash flow management feature processes financial data swiftly, offering users real-time insights. This unique functionality allows finance teams to automate routine tasks, enabling them to focus on strategic decision-making and eliminating manual errors, ultimately saving time and enhancing overall productivity.

Dynamic Forecasting

Pennyflo’s dynamic forecasting feature utilizes historical financial data to project future cash scenarios. This innovative tool helps businesses prepare for potential cash shortages or surpluses, empowering users to make proactive financial decisions. With accurate forecasts, organizations can mitigate risks and drive sustainable growth.

Automated Banking & Reconciliations

Pennyflo offers automated banking and reconciliation features that simplify financial operations. This unique functionality ensures accurate and timely transactions while reducing the manual workload for finance teams. Users benefit from real-time reconciliations, enhancing accuracy and saving valuable time in cash management processes.