Sixfold

About Sixfold

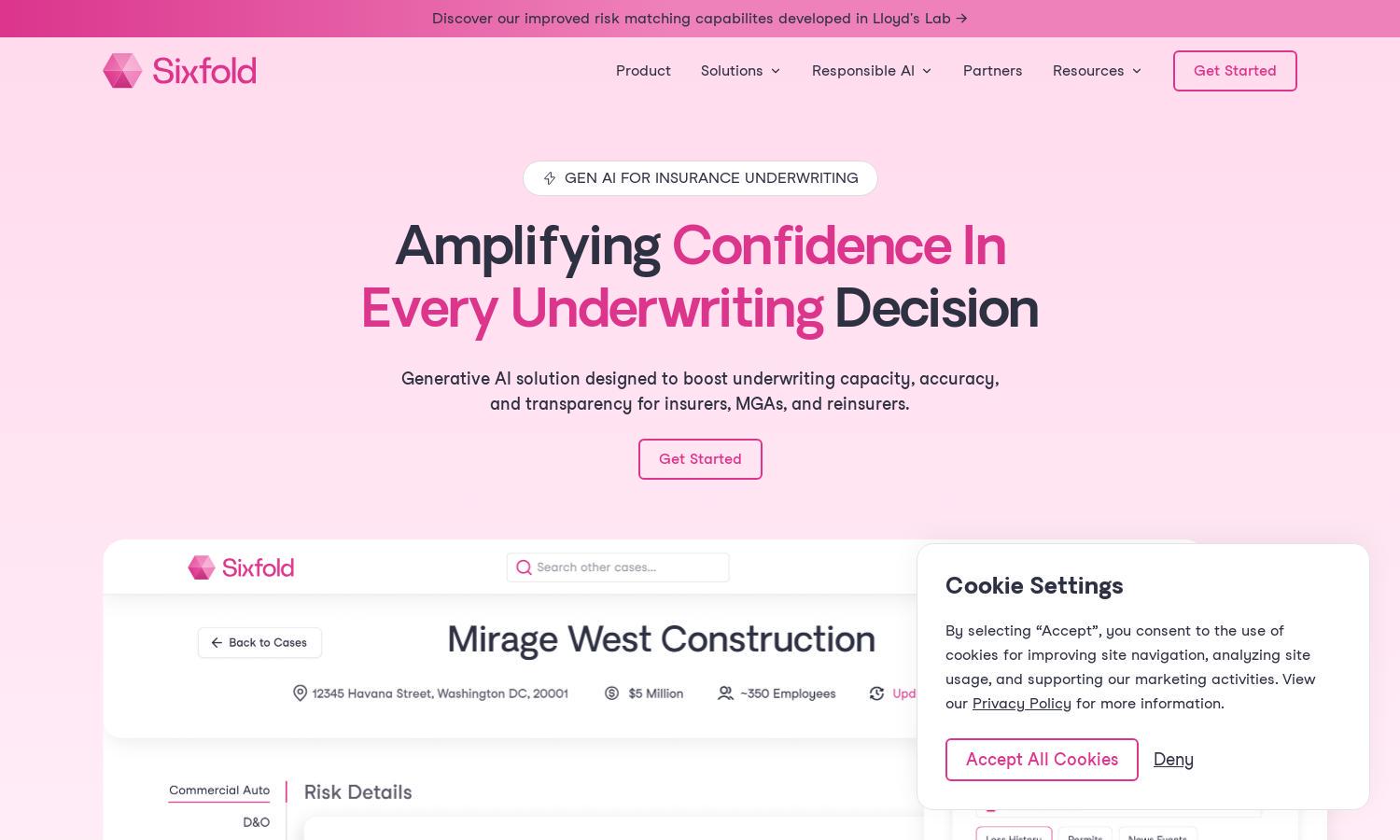

Sixfold empowers insurance underwriters by offering generative AI tools designed to automate and streamline the underwriting process. By ingesting guidelines and extracting relevant risk data, Sixfold simplifies decision-making and enhances risk assessment, ensuring smoother workflows and better compliance for insurance professionals aiming to innovate their practices.

Sixfold offers tiered pricing plans tailored to various underwriting needs. Users can choose from basic, professional, and enterprise levels, each providing added features and support. Upgrading enhances access to advanced capabilities, making compliant risk assessment easier, more efficient, and ultimately more profitable, ensuring value for all users.

Sixfold's user interface is intuitively designed for seamless navigation, reflecting a focus on user experience. The layout facilitates quick access to tools such as risk analysis and compliance tracking, creating an engaging environment for underwriters. Unique features ensure users can easily adapt and optimize their underwriting processes with confidence.

How Sixfold works

Users start by onboarding with Sixfold by uploading their underwriting guidelines. The system ingests these documents, identifying essential risk factors. Users can then easily navigate features to extract data from submissions and third-party sources. With generative AI, Sixfold provides tailored recommendations and summaries, streamlining decision-making and ensuring transparency throughout the underwriting process.

Key Features for Sixfold

Generative AI Co-Pilot

Sixfold's generative AI co-pilot revolutionizes underwriting by automating data synthesis and risk analysis, empowering underwriters to focus on strategic decision-making. This unique feature highlights how Sixfold enhances efficiency and transparency, transforming traditional insurance processes into innovative, modern workflows.

Risk Signal Detection

Sixfold excels in detecting risk signals, pinpointing positive, negative, and disqualifying factors effortlessly. This feature ensures that underwriters can make informed decisions quickly, enhancing compliance and overall accuracy in the underwriting process while maximizing efficiency and minimizing oversight.

Transparency & Compliance

Sixfold champions transparency in underwriting processes, providing traceability for every decision made. This key feature reassures users by ensuring that all actions are documented, fostering trust and compliance with regulatory standards, crucial for modern insurance practices that prioritize accountability and integrity.