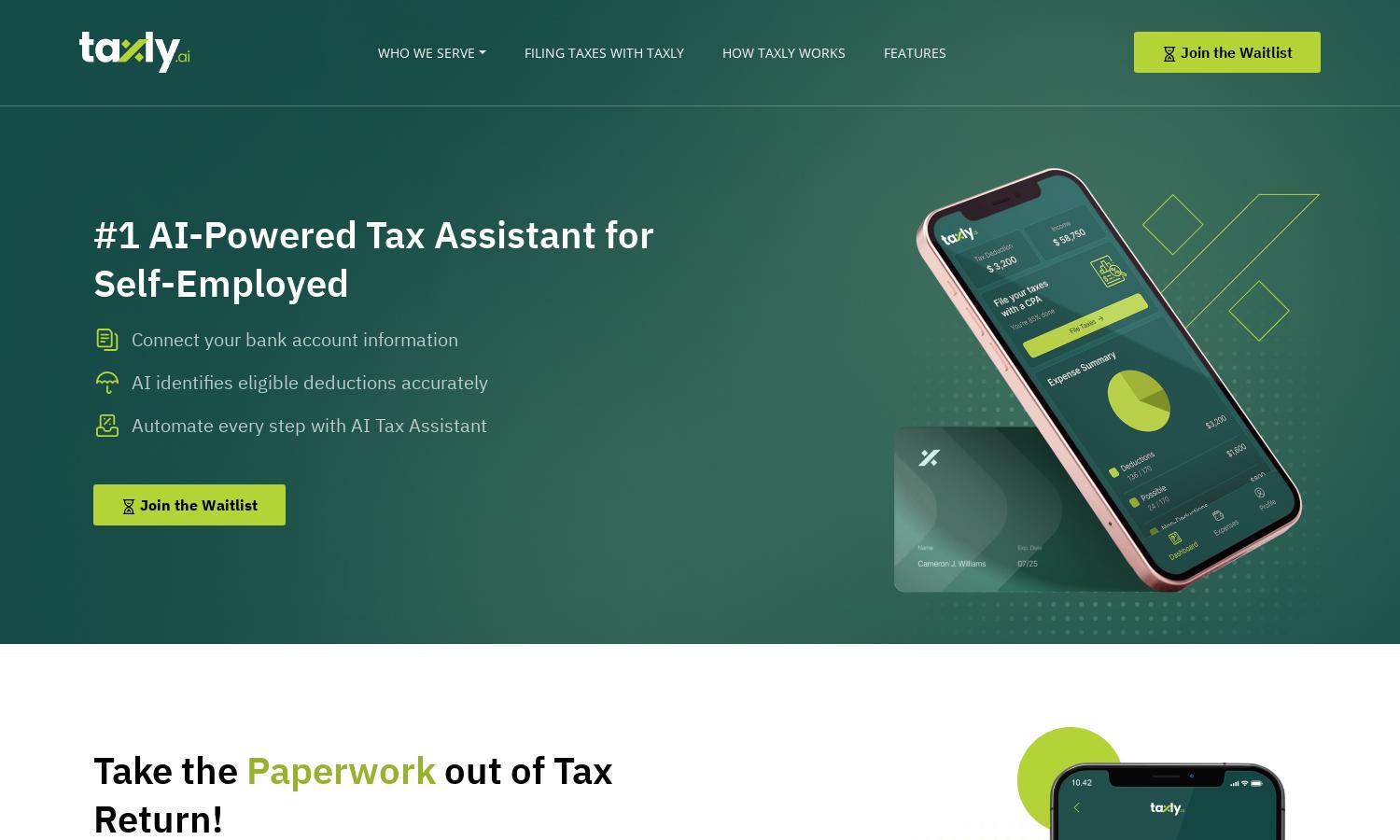

Taxly.ai

About Taxly.ai

Taxly.ai simplifies tax filing for self-employed professionals with its innovative AI-powered platform. By connecting bank accounts, users can effortlessly identify deductions and tax savings. The user-friendly interface, combined with expert CPA support, enables freelancers to manage taxes efficiently and accurately, ensuring no deductions are missed.

Taxly.ai offers a range of pricing plans tailored to various user needs, starting from a basic tier for individuals to premium options for small businesses. Each subscription grants access to unique features like personalized tax consultations and automation tools. Upgrading enhances user experience and maximizes tax savings.

Taxly.ai boasts an intuitive user interface designed for seamless navigation and ease of use. The layout allows users to quickly access essential tax tools and features, making tax management less stressful. Unique functionalities highlight personal tax activity insights, enhancing the overall user experience while staying organized.

How Taxly.ai works

Users begin by signing up for Taxly.ai and connecting their transaction records effortlessly. The platform utilizes advanced AI to scan transactions for eligible deductions. Users then receive personalized recommendations and can approve or reject deductions through an intuitive interface. With 24/7 CPA support, users can ensure their tax activities are optimized for maximum savings.

Key Features for Taxly.ai

AI-Powered Tax Identification

The AI-Powered Tax Identification feature of Taxly.ai streamlines the tax deduction process for users. By automatically scanning transactions, Taxly.ai identifies eligible deductions, ensuring that users never miss potential savings. This innovative tool maximizes tax efficiency, making filing simpler and more advantageous.

Real-Time Expense Tracking

Taxly.ai's Real-Time Expense Tracking feature allows users to monitor their expenditures effortlessly. By categorizing expenses automatically, users can ensure accurate deductions according to ATO Tax guidelines. This functionality simplifies financial management, providing users with clarity and confidence in their tax filings.

Expert CPA Support

The Expert CPA Support feature of Taxly.ai ensures that users receive professional guidance throughout their tax filing process. With access to certified CPA professionals, users can obtain personalized advice on tax strategies, helping to enhance compliance and maximize savings.

You may also like: