About aVenture

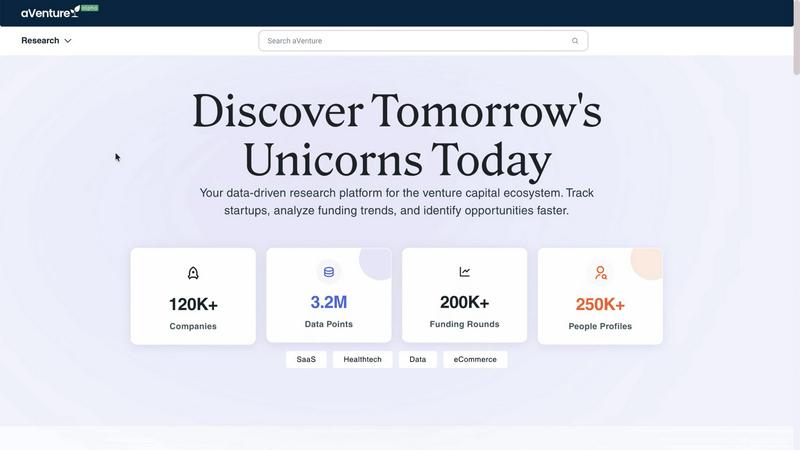

Navigating the private market is a monumental challenge characterized by fragmented information, overwhelming news cycles, and critical signals buried in noise. Traditional research methods are too slow and manual, forcing investors, founders, and operators to make high-stakes decisions with incomplete or outdated intelligence. aVenture is the definitive solution to this problem. It is an institutional-grade research platform built specifically for private company and venture capital analysis. By aggregating and intelligently analyzing data on over 107,000 active companies, $12.7 trillion in funding, and 29,000+ investors, aVenture transforms raw data into actionable insight. Its core differentiator is an AI analyst that continuously reads the latest coverage to summarize traction, highlight risks, and explain how new events may impact a company's trajectory. Designed for professionals who cannot afford to miss a beat, aVenture empowers users to conduct deep due diligence, map competitive landscapes, track material signals, and build targeted outreach lists with precision and speed, all within a collaborative workspace. It is the essential platform for anyone who needs to understand and act on venture capital and private market dynamics.

Features of aVenture

Institutional-Grade Company Database

Access a comprehensive, constantly updated database tracking over 107,000 active venture-backed companies across 132 countries. The platform consolidates 12.4 million+ data points from 1,200+ sources, providing detailed profiles on funding histories, ownership structures, competitive positioning, and key personnel. This centralized intelligence replaces fragmented spreadsheets and manual searches.

AI-Powered Analyst & Signal Tracking

aVenture's core differentiator is its AI analyst that continuously scans and reads the latest news, reports, and coverage. It automatically summarizes company traction, highlights potential risks, and explains how new events or announcements may impact a company's future trajectory, ensuring you never miss a critical signal buried in the noise.

Advanced Funding & Investor Intelligence

Analyze the flow of capital with precision using data on $12.7 trillion in total funding. Track detailed funding rounds, investor participation trends, and valuation changes across 29,779 investors. This feature allows you to identify which firms are most active in specific sectors and understand broader market investment patterns.

Collaborative Research & Outreach Workspace

Move from insight to action within a single platform. Teams can conduct collaborative due diligence, map competitive landscapes, and save companies to shared lists. Build and manage targeted outreach lists for investors or partners directly within the workspace, streamlining the entire research and engagement workflow.

Use Cases of aVenture

Venture Capital Due Diligence

VC investors use aVenture to conduct thorough, rapid due diligence on potential investments. The platform enables deep analysis of a target company's full funding history, cap table, competitive threats, and market signals summarized by the AI, allowing for faster, more informed investment decisions with reduced risk.

Competitive Landscape Mapping

Founders and corporate strategists leverage aVenture to map their competitive environment. They can identify direct and indirect competitors, analyze their funding, track their latest news and product launches, and understand investor backing to refine their own positioning and strategy.

Investor Sourcing & Relationship Management

Startups seeking funding use aVenture to build targeted investor lists. They can identify the most relevant VC firms and angel investors based on past investments in their sector, stage, and geography, and track recent investment activity to time their outreach effectively.

Market Trend Analysis & Opportunity Identification

Investment professionals and analysts rely on aVenture to spot emerging trends and sectors. By tracking funding volumes, hot sub-sectors, and the rise of new companies, users can identify high-growth opportunities early and build a data-backed thesis for where to allocate attention and capital.

Frequently Asked Questions

What types of companies are tracked on aVenture?

aVenture tracks over 107,000 active, venture-backed private companies from startups to late-stage unicorns across 132 countries. The database focuses on high-growth companies that have raised institutional capital, providing comprehensive coverage of the global private market landscape.

How does the AI analyst work?

The AI analyst continuously monitors and processes information from thousands of data sources and news publications. It identifies material events related to tracked companies, then generates concise summaries that explain the context, potential impact on traction, and highlight any risks, acting as a tireless research assistant.

How current is the data on the platform?

aVenture's data is updated in real-time. The platform aggregates information from 1,200+ sources, and the AI analyst is constantly reading the latest coverage. This ensures users have access to the most current funding events, news, and market signals, not outdated or stale information.

Can teams collaborate on aVenture?

Yes, aVenture is designed as a collaborative workspace. Teams can work together on research projects, share company lists and insights, conduct joint due diligence, and manage outreach campaigns within the platform, ensuring alignment and efficiency across all members.

Pricing of aVenture

Pricing information is not publicly listed on the provided website content. For detailed information on plans, tiers, and subscription costs, please visit the official aVenture website or contact their sales team directly.

Explore more in this category:

Top Alternatives to aVenture

Opal44

Opal44 transforms your GA4 data into clear, actionable insights in plain English for smarter website traffic decisions.

Fusedash

Fusedash transforms raw data into intuitive dashboards and charts, empowering teams to act on insights instantly.

Redbark

Effortlessly sync your Australian bank and brokerage data to Google Sheets and YNAB for seamless financial tracking.

SoloTools

SoloTools instantly creates polished client proposals with AI, saving you hours of work.

QuoteCraft AI

QuoteCraft AI creates winning proposals for freelancers by fixing unclear scope and bad pricing.

BlitzAPI

BlitzAPI empowers your growth team with instant access to clean B2B data through scalable, powerful APIs for GTM.

echoloc

Echoloc uncovers buyer intent in job posts, equipping sales teams to target accounts ready to invest.

EliteReads

Unlock your potential with 2,500+ book recommendations from 150 elite thinkers for personal and professional growth.