About Finanz

The world of personal finance is often intimidating, filled with complex jargon and overwhelming advice that leaves many feeling lost and anxious about their money. This knowledge gap can lead to poor spending habits, missed savings opportunities, and a general sense of being unprepared for the future. Finanz tackles this pervasive challenge head-on. It is a cutting-edge financial literacy app designed to demystify money management for everyone. Its core mission is to transform the daunting task of learning about finance into an accessible, engaging, and even enjoyable daily habit. Finanz achieves this through a unique, guided method that requires just five minutes a day, making consistent learning sustainable rather than a chore. The app serves a wide audience, from high school and university students taking their first steps, to working professionals and anyone seeking to improve their financial well-being. By offering personalized learning paths, interactive lessons, and practical quizzes, Finanz provides the essential tools to confidently learn how to invest, save, and manage expenses. It’s more than an app; it’s a personal finance coach that empowers users to build a healthier, more informed relationship with their money, turning financial stress into financial confidence.

Features of Finanz

Personalized Daily Learning Paths

Finanz understands that everyone learns differently. Instead of a one-size-fits-all approach, the app creates a custom study journey tailored to your individual knowledge level, goals, and learning pace. This adaptive system ensures you are always challenged appropriately, building on what you know and introducing new concepts in a logical, manageable sequence. This personalization is key to making complex topics feel approachable and relevant to your specific financial situation.

The 5-Minute Daily Method

The biggest barrier to financial education is often perceived lack of time. Finanz brilliantly solves this with its core promise of just five minutes of learning per day. This micro-learning strategy breaks down intimidating subjects into bite-sized, digestible lessons. This approach prevents cognitive overload, builds a consistent habit, and proves that profound knowledge can be accumulated through small, daily investments of time, mirroring the principle of compound interest in learning itself.

Interactive Lessons & Knowledge Quizzes

Passive reading is ineffective for retaining complex information. Finanz combines concise video lessons and written content with interactive quizzes to reinforce learning. This format actively engages your brain, testing your understanding immediately after a lesson. This cycle of learning and application solidifies knowledge, boosts confidence, and makes the process intuitive and enjoyable, transforming study from a duty into a rewarding activity.

Premium Advanced Content & Tools

For users ready to deepen their expertise, Finanz Premium unlocks an exclusive tier of advanced educational content and practical tools. This includes in-depth video courses on sophisticated investment strategies, advanced budgeting techniques, and specialized financial instruments. These premium resources are designed to rapidly develop the practical skills needed for effective money management and investing, offering serious value beyond the foundational free content.

Use Cases of Finanz

The Complete Beginner Building Foundations

You feel lost when hearing terms like ETFs, compound interest, or asset allocation. Finanz is your perfect starting point. The app gently introduces financial fundamentals with clear explanations and zero assumed prior knowledge. Its structured path guides you from basic budgeting to understanding different investment vehicles, building a solid foundation without the stress or confusion of sifting through unreliable online information.

The Student Supplementing Academic Studies

University finance courses can be theoretical and fast-paced. Finanz acts as the perfect practical companion. Students can use the app to visualize concepts taught in class, test their knowledge with quizzes, and explore real-world applications. As attested by users, many find the app's clear, applied approach even more effective than traditional lectures for grasping and retaining complex material.

The Professional Seeking Practical Money Management

As a working adult, you earn money but aren't sure how to optimize it. Between bills, expenses, and savings goals, it's easy to feel stuck. Finanz provides actionable strategies for managing daily expenses, creating an effective budget, and starting an investment plan aligned with your income. The 5-minute daily format fits seamlessly into a busy schedule, turning idle moments into productive financial growth.

The Aspiring Investor Gaining Confidence

You have some savings but are fearful of the stock market and unsure where to begin. Finanz Premium offers the deep dive you need. Through advanced courses and tools, you can learn about risk assessment, portfolio diversification, and market analysis in a safe, educational environment. This knowledge empowers you to move from hesitation to action, making informed investment decisions with greater confidence.

Frequently Asked Questions

Is Finanz suitable for someone with absolutely no finance knowledge?

Absolutely. Finanz is specifically designed for beginners. The app starts with the very basics, explaining core concepts in plain, jargon-free language. The personalized learning path assesses your starting point and builds knowledge incrementally. Many users have reported that the app completely changed their perspective by making finance understandable and accessible for the first time.

What is the difference between the free and premium version?

The free version of Finanz offers a robust foundation, including personalized daily lessons, quizzes, and core content on saving and budgeting. Finanz Premium unlocks the full ecosystem: exclusive, in-depth video courses on advanced topics like investing strategies, advanced financial tools, and comprehensive modules designed to accelerate your practical money management skills. Premium is for users who want to move beyond basics and gain serious, actionable expertise.

How does the 5-minute daily method actually work?

The method is based on micro-learning and consistency. Each day, the app presents a short, focused lesson on a single financial concept, followed by a quick quiz to reinforce it. This requires only a few minutes of your time. The power lies in the cumulative effect; these small, daily sessions compound over weeks and months, building a comprehensive understanding of finance without ever feeling like a time-consuming burden.

Can I cancel my Finanz Premium subscription at any time?

Yes, you have complete flexibility. You can cancel your Finanz Premium subscription at any time. The app promotes this freedom, noting "Cancella il piano quando vuoi!" (Cancel the plan whenever you want!). This allows you to try the advanced features risk-free and only pay for them as long as you find the value beneficial for your financial education journey.

Pricing of Finanz

Finanz offers a premium subscription tier, Finanz Premium, which provides access to exclusive advanced content and tools. The pricing is structured on a monthly or annual basis:

- Monthly Plan: Priced at €6.99 per month.

- Annual Plan: Offered at a discounted rate, saving users €60 compared to the monthly plan over a year. The exact annual total is not listed, but the savings are emphasized.

Both plans can be tried and canceled at any time, providing flexibility for the user. The free version of the app with core features remains available.

Explore more in this category:

Top Alternatives to Finanz

The Ultimate Piano

The Ultimate Piano offers an immersive online practice experience with realistic sounds, MIDI support, and interactive.

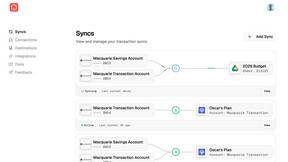

Redbark

Effortlessly sync your Australian bank and brokerage data to Google Sheets and YNAB for seamless financial tracking.

MeloLingua

MeloLingua transforms language learning by using personalized stories to boost confidence and fluency from day one.

Ricco - Financial Literacy Game

Master your money with Ricco, the engaging financial literacy game that teaches budgeting, investing, and smart money.

LessonPlanGenerator

LessonPlanGenerator creates standards-aligned lesson plans in under 60 seconds, giving teachers more time to teach.

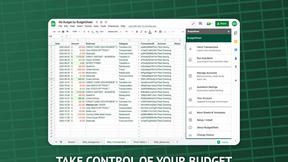

BudgetSheet

Effortlessly import live bank transactions into Google Sheets for seamless budgeting and financial tracking.

ConvertBankToExcel

ConvertBankToExcel transforms PDF bank statements into Excel, CSV, QBO, and more with 99% accuracy in under 30 seconds.

ExpenseManager

Easily track expenses, split bills, and forecast cash flow for individuals, couples, and groups with ExpenseManager.