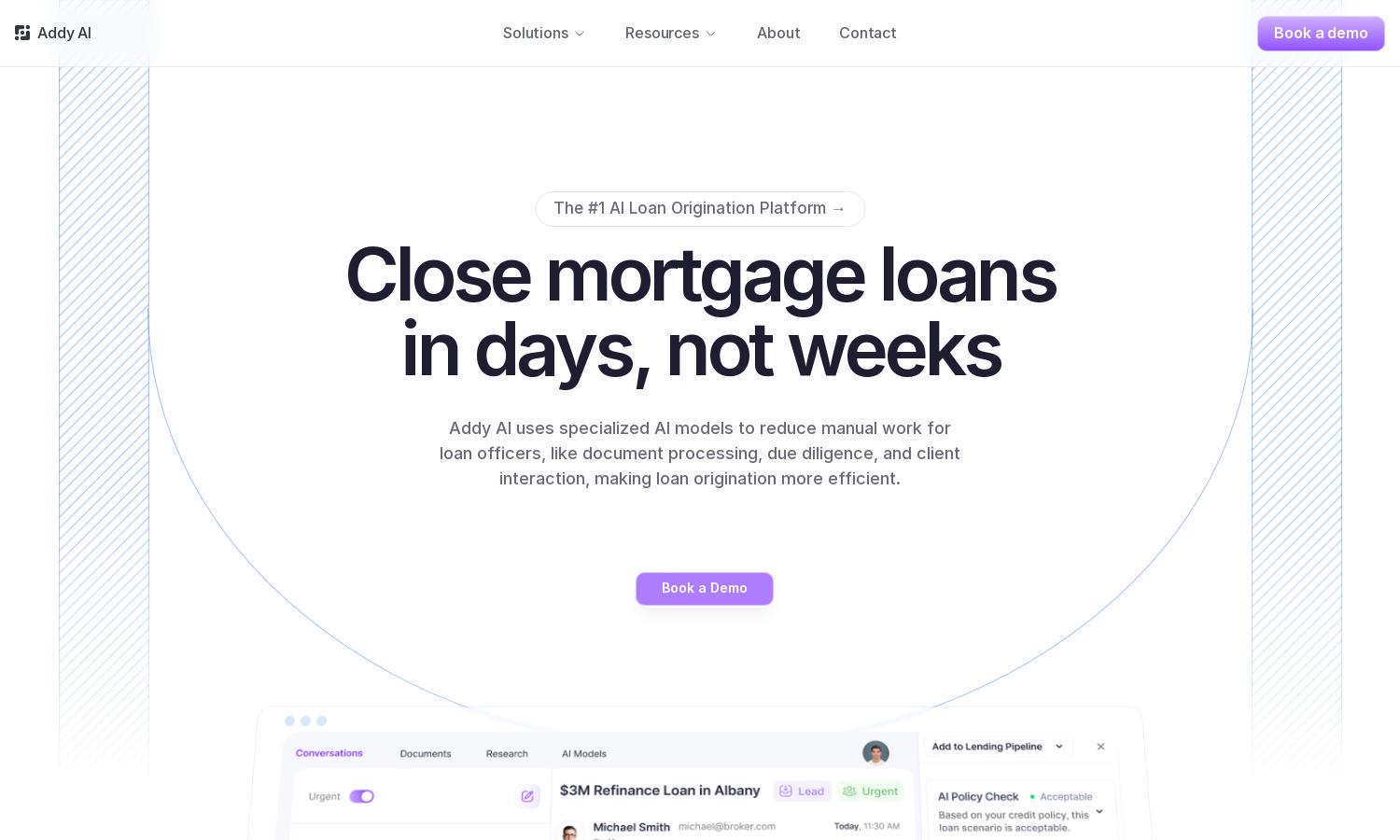

Addy AI

About Addy AI

Addy AI revolutionizes the mortgage lending process by offering tailored AI models that save time and enhance efficiency for loan officers. This innovative platform automates essential tasks like document processing and client follow-ups, allowing lenders to close loans much faster and improve client satisfaction in the competitive lending market.

Addy AI offers flexible pricing plans catering to various lending needs, with a basic tier for startups and premium tiers providing advanced features. Each plan grants users access to time-saving automation tools, and those who upgrade receive enhanced support and exclusive features, maximizing productivity and workflow efficiency.

The user interface of Addy AI is designed for simplicity and ease of navigation, ensuring a seamless experience for mortgage lenders. With a clean layout and intuitive features, users can effortlessly access and deploy AI tools, making the platform both accessible and powerful, enhancing productivity across the board.

How Addy AI works

Users begin their journey with Addy AI by signing up and configuring their custom AI models tailored to specific lending needs. They can easily navigate through various features, such as document processing and client interaction automation. By integrating with existing CRMs and tech stacks, users experience a streamlined workflow that minimizes manual efforts and accelerates loan origination processes.

Key Features for Addy AI

Custom AI Models

Addy AI’s custom AI models enable mortgage lenders to automate the intricate loan origination process, drastically reducing manual workload. These tailored models improve efficiency by processing documents and handling client inquiries instantaneously, positioning Addy AI as a vital tool for modern lenders aiming for enhanced productivity.

Document Processing Automation

Addy AI offers advanced document processing automation that helps mortgage lenders streamline their workflows. Users can extract relevant loan data in seconds, increasing efficiency and accuracy. This feature allows lenders to focus on more critical tasks, enhancing their overall productivity with Addy AI as their trusted solution.

Client Follow-Up Automation

The client follow-up automation feature of Addy AI is designed to keep borrowers and brokers informed and engaged. This unique capability ensures timely communication, significantly elevating client satisfaction. With Addy AI, lenders can maintain a competitive edge by providing excellent service while reducing the manual workload of loan officers.

You may also like: