Private Equity List

Effortlessly access AI-enhanced private equity and venture capital data to secure funding for your business.

Visit

About Private Equity List

PrivateEquityList.com is an advanced database specifically designed for private equity firms and venture capital funds. It offers a super intuitive search system that simplifies the process of finding potential investors for startups and businesses across various stages of funding. With over 10,300 users, the platform is trusted by startups, consultants, universities, and business owners for its comprehensive data and user-friendly experience. The recent addition of an AI search function enhances the user experience, making it even easier to find relevant PE/VC data. By focusing on targeted filters and streamlined access to investment team contacts, Private Equity List provides a cost-effective alternative to traditional platforms like Pitchbook and Crunchbase, ensuring that users can efficiently raise funds, establish partnerships, and conduct in-depth research.

Features of Private Equity List

AI-Powered Search Function

The AI search feature allows users to effortlessly find PE/VC investors and funding options tailored to their specific needs. This intelligent system provides quick, accurate results while enabling users to refine their searches with multiple filters.

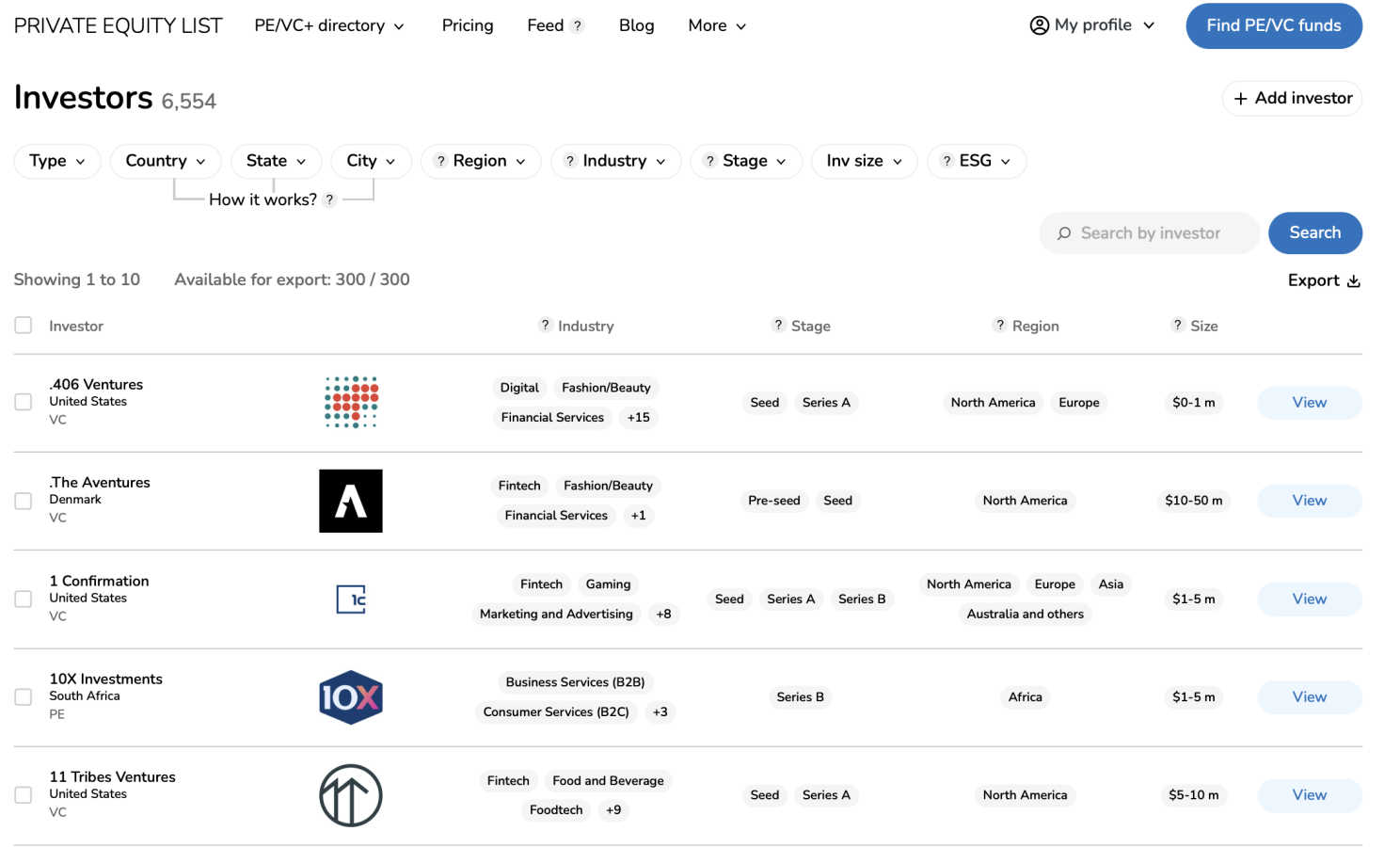

Comprehensive Investor Database

With a database of over 7,045 PE/VC investors and 27,160 contacts, users can access a wealth of information about investment teams. This extensive database is regularly updated, ensuring that users have access to the latest investment opportunities.

Targeted Filtering Options

Users can take advantage of powerful filtering options that allow them to narrow down their search based on geographic location, investment stage, and specific investment thesis. This targeted approach helps users quickly identify the most suitable investors for their projects.

User-Friendly Interface

The platform is designed with a seamless lightweight UI/UX, making it easy for users to navigate through the vast amount of data. The intuitive design ensures that even those who are not tech-savvy can find and utilize the information they need without hassle.

Use Cases of Private Equity List

Startups Seeking Funding

Startups can leverage Private Equity List to identify and connect with potential investors ranging from pre-seed to Series C funding. By utilizing the platform's filters, they can find investors that align with their specific funding needs and geographical focus.

Consultants and Advisors

Consultants can create tailored investor shortlists for their clients, helping them close fundraising and M&A mandates efficiently. The platform's detailed data enables quick and effective outreach strategies, boosting success rates for consultants.

Venture Capital Ecosystem

VCs, accelerators, and venture studios can utilize the database to find co-investors and strategic partners. This collaborative approach can enhance the funding prospects of their portfolio companies during subsequent funding rounds.

Research and Reporting

Universities, journalists, and researchers can tap into the intelligence provided by Private Equity List for various research purposes. The platform's comprehensive data supports in-depth analysis and reporting on trends in the private equity and venture capital landscape.

Frequently Asked Questions

How does the AI search function work?

The AI search function utilizes advanced algorithms to quickly analyze user queries and return relevant PE/VC investor data. It assists in generating tailored results, but users are advised to verify the accuracy of the information provided.

Can I access the platform for free?

Yes, Private Equity List offers basic functionalities for free, allowing users to explore the database and utilize the AI search feature without needing to provide a credit card.

What types of investors are included in the database?

The database encompasses a wide range of investors, including private equity firms, venture capital funds, accelerators, and other funding sources. This diversity ensures that users can find the right fit for their specific funding needs.

Is the data on Private Equity List regularly updated?

Yes, the platform is committed to maintaining accurate and relevant data. The database is updated nearly daily to ensure that users have access to the most current information on PE and VC investors.

You may also like:

Fieldtics

Fieldtics is an all-in-one platform for service businesses, streamlining scheduling, customer management, invoicing, and getting paid.

Moon Banking

The largest global bank dataset with AI-native integrations (MCP, OpenClaw, API). For analysts, marketers, developers, institutions.

Tailride

AI-powered invoice and receipt automation from email and web portals